Buy and sell AI swinger

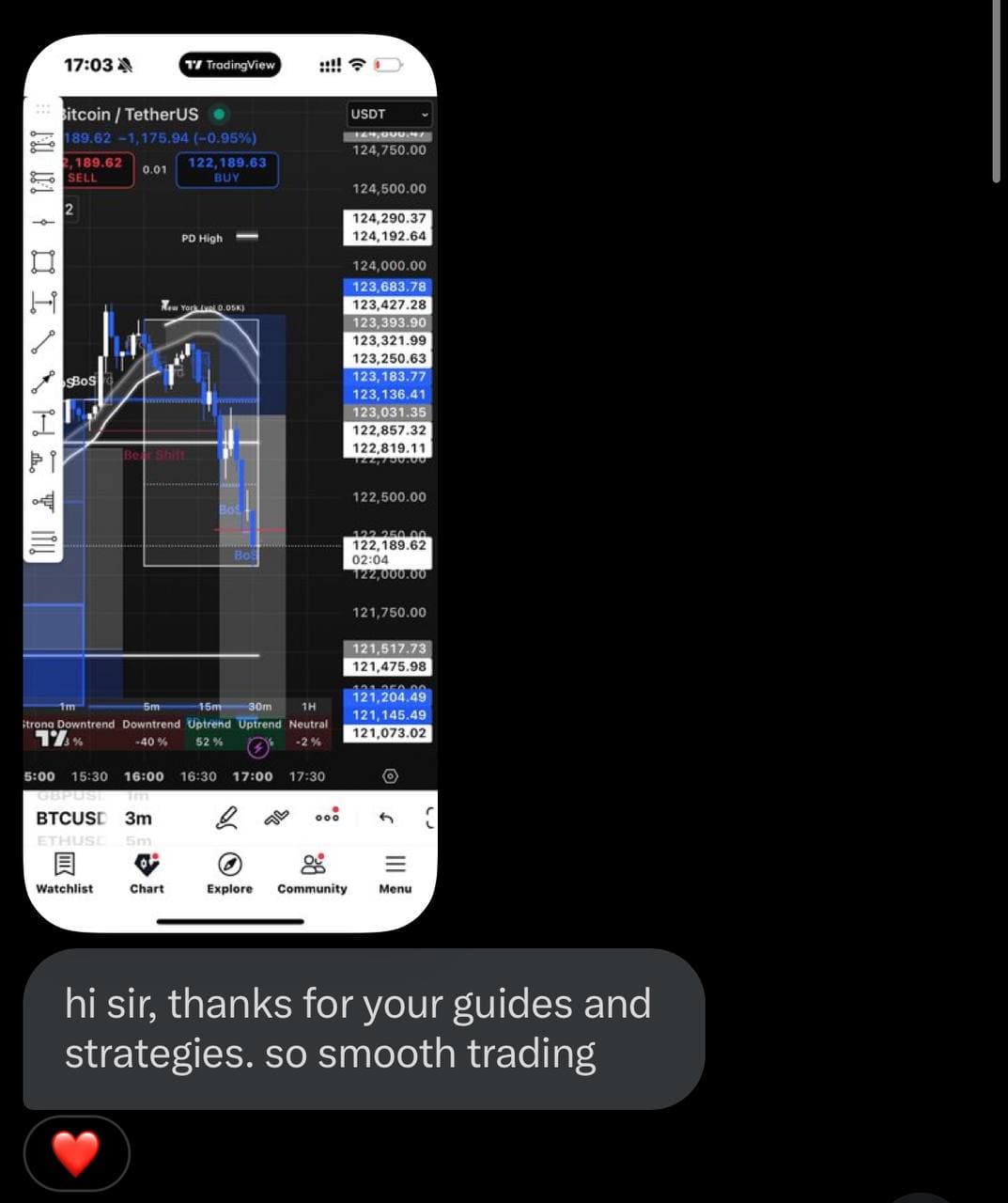

swing buy & sell zones

Algorithmic swing signals for top memecoins (DOGE, SHIB, PEPE, WIF, FLOKI) on 1H–4H charts. Combines market structure (BOS / CHoCH), liquidity sweeps, volume impulse and volatility filters to highlight probable continuation or reversal zones. Historical hit rate in trending regimes, but performance varies with conditions. Use alongside risk management—no guarantee; not financial advice.